Hybrid Advice – Financial Institution

In late 2022 we conducted a wide-ranging study of the Hybrid advice market, that was refreshed in Q1 of 2023 to reflect the rapid pace of developments taking place in this space from the existing technology vendors and to make room for the new entrants that have come to market. We now hold over 6,300 data points, comparing 9 Hybrid advice solutions, putting us in a unique and powerful position to not only assist advisers with their partner selection process, but also share back with providers detailed analysis of how their proposition compares with their competitors, based upon the survey questions completed.

Hybrid advice white paper

In recent years, there has been a growing trend of financial advice practices deploying technology that involves the client more directly in the advice process, e.g. completion of online fact finds, accessing data and documents via client portals and online risk profilers.

Financial Technology Research Centre (FTRC) firmly believe that advice firms who invest in their technology and digitise the client experience will thrive and survive. Forward thinking advice firms are now embedding client-facing digital solutions into their propositions, these firms have already embarked on a journey towards Hybrid Advice.

In recognition of developments in this area, FTRC have conducted an extensive market study into the emerging Hybrid Advice market in 2023 to gain deeper insights into the breadth and depth of the solutions that are available to advice firms today.

Our research identified two key challenges facing the Hybrid Advice market. Firstly, advisers need help to understand exactly what Hybrid Advice solutions can deliver. Secondly, technology vendors, whilst having delivered some very impressive capability, will need to improve the breadth and depth of their offerings if they are to deliver solutions that will address the needs of their prospective clients i.e. advice firms.

Testimonial

“We approached FTRC as were looking to explore Hybrid Advice partners for our business. We had an understanding of what we thought we required, but FTRC helped us broaden our thinking and expand our knowledge in this market.

We worked together for a couple of months looking at who the key players in the market are and what functionality they could offer to our business. FTRC carried out a detailed RFI which took us through a selection process to help us identify potential partners.

Their expertise and detailed understanding of the advice tech market enabled us to work far quicker and more efficiently. They played the role of our ‘Critical Friend’ to act as a moderator, external industry voice and sounding board to help us make detailed and informed decisions”

Ian Plumpton, Chief Operating Officer, Attivo

Are you looking to understand more about Hybrid Advice or enter this market?

Over the last 12 months we have worked with both advisers and providers to gain a deep understanding of the Hybrid Advice landscape and Advisersofware.com now holds over 6,300 data points comparing various Hybrid Advice providers putting us in a unique and powerful position too:

- Assist advisers with their partner selection process,

- Help providers understand how their proposition compares with their competitors, and

- Provide knowledge and support to anyone looking to understand more in this space or enter the market.

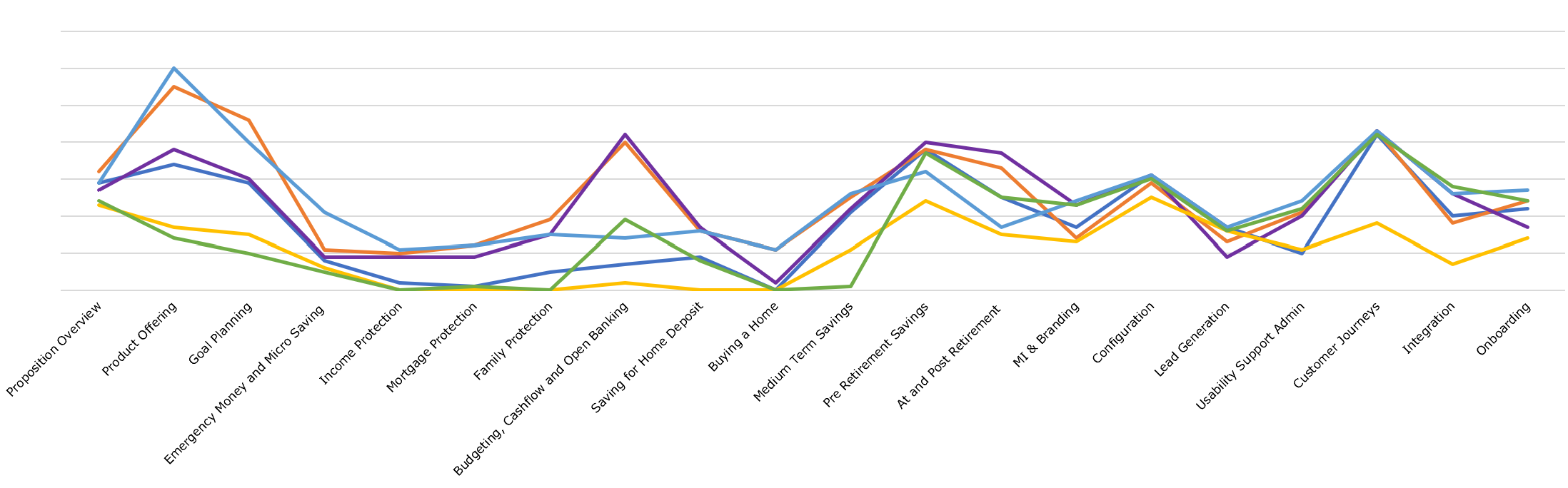

If you are a financial institution and are looking to gain further insight into the Hybrid Advice market, Advisersoftware.com can produce a report that looks in detail at over 900 questions surveying nine Hybrid Advice solutions.

This report will provide insight into 20 stages of the Hybrid Advice process comparing each provider and benchmarking their strengths and weaknesses, including our view on how the Hybrid Advice market is evolving, current trends and areas we see for improvement.

CONTACT US

If your organisation is looking to gain a better understanding of this evolving and rapidly developing market

please contact jason.green@ftrc.co.uk

OR